The role of CPA in Texarkana, TX, is changing rapidly. As technology advances, accountants face new challenges in blockchain and transaction validation. Blockchain technology changes how transactions are verified, leading to more transparency and security. Accountants now need to understand these digital ledgers and how they affect traditional accounting practices. If you are a CPA, you must adapt to these changes and embrace new tools and techniques. This shift offers an opportunity to expand your skill set and stay relevant. You’ll find yourself not just crunching numbers, but ensuring the integrity of complex digital transactions. Your expertise will be critical in navigating this evolving landscape. It’s an exciting, necessary shift that calls for a proactive approach. Embrace this transformation, and you can help build trust and accuracy in financial reporting. In this new era, your role will be crucial to bridging traditional methods with innovative solutions.

Understanding Blockchain Basics

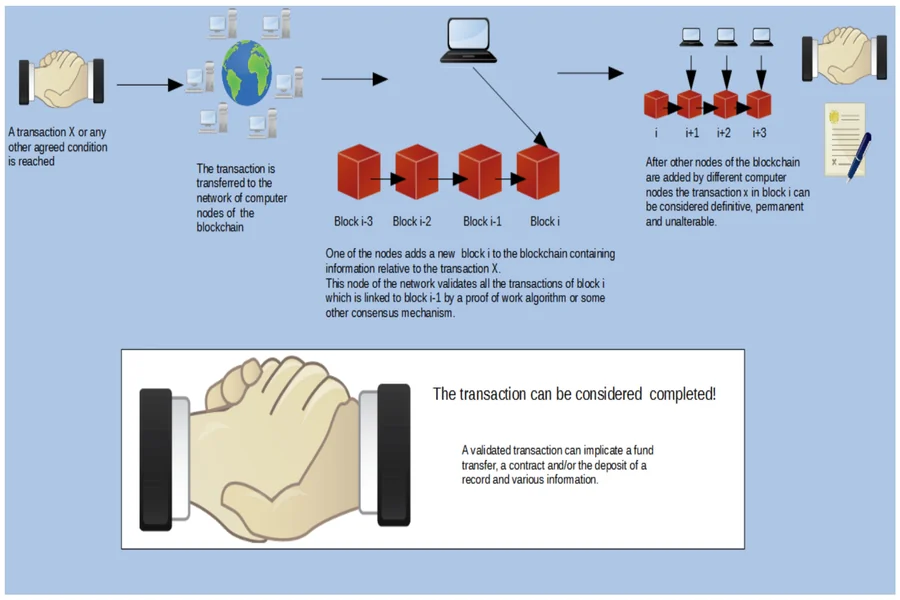

Blockchain technology relies on a decentralized ledger. It records transactions across several computers, making it almost impossible to alter past entries. This ensures transactions remain secure and transparent. For accountants, comprehending these digital systems is essential. You are tasked with verifying transactions and ensuring their accuracy for your clients. As a CPA, staying up-to-date with advancements in blockchain helps you maintain credibility and offer informed advice.

Impact on Accounting Practices

As blockchain becomes more integrated into financial processes, traditional accounting practices face disruption. Here’s what this means for you:

- Transaction Speed: Blockchain can process transactions faster than conventional methods.

- Data Integrity: The immutability of blockchain records guarantees accuracy.

- Reduced Fraud: Enhanced security measures diminish the risk of fraudulent activities.

Adapting to these changes requires new skills and knowledge. This means engaging with blockchain technology and understanding how it influences the financial landscape.

New Tools for CPAs

Several tools are available that you can utilize to integrate blockchain technology into your work:

- Smart Contracts: Automate contract execution without requiring intermediaries.

- Blockchain Analytics: Help monitor transactions and detect irregularities.

- Decentralized Applications (dApps): Provide solutions for various financial operations.

Leveraging these tools allows you to improve efficiency and accuracy in your accounting practices.

Opportunities for Growth

This shift presents significant opportunities for growth and development. By understanding blockchain, you can enhance your services and offer clients more value. Clients will look to you for guidance in navigating these changes. You’ll also be able to collaborate with tech experts to create innovative solutions that meet client needs.

Challenges to Consider

While blockchain technology offers many benefits, it also presents challenges. These include:

- Complexity: Understanding the technical aspects of blockchain can be daunting.

- Regulatory Concerns: Navigating the regulatory environment is crucial.

- Data Privacy: Ensuring client data remains private and secure.

By educating yourself and staying informed, you can overcome these challenges and help others do the same.

Comparative Analysis

The table below compares traditional transaction methods with blockchain technology:

| Feature | Traditional Methods | Blockchain Technology |

|---|---|---|

| Transaction Speed | Slow | Fast |

| Security | Moderate | High |

| Transparency | Limited | High |

| Fraud Risk | Higher | Lower |

Educational Resources

To stay informed, consider using resources offered by government or educational institutions. For instance, the Federal Reserve provides insights on the economic implications of blockchain. Similarly, the National Institute of Standards and Technology offers guidance on blockchain standards and practices. These resources can assist you in understanding and applying blockchain technology effectively.

Conclusion

In conclusion, blockchain technology is reshaping the accounting profession. As a CPA, embracing this change is essential. You must equip yourself with new skills and tools to meet client demands and maintain a competitive edge. By doing so, you ensure accuracy, security, and transparency in financial transactions. This transformation offers a chance to grow and innovate, solidifying your role in the future of accounting.